In the ever-changing Forex market, every trader is in search of reliable trading tools to obtain stable profits. Today, we’d like to introduce you to a highly promising tool — the Shater Multi-Currency Expert Advisor (EA). It is an indicator-based grid trading system. With its customizable parameters, excellent backtesting results, and verified performance through independent monitoring, it has attracted the attention of many traders. Next, we will take an in-depth look at its various features, analyze the test results, and provide practical usage suggestions.

Core Features: Demonstrating Outstanding Advantages

The Shater EA is applicable to the MetaTrader 4 trading platform. Currently at version 3.0, it mainly supports currency pairs such as AUDUSD, EURCHF, and GBPUSD. The trading timeframe is set to H1, and it supports 24/7 trading around the clock. For broker selection, RoboForex and IcMarket are recommended. Using the Shater EA on these two platforms can better leverage its performance advantages.

In terms of installation, the operation is relatively simple. Just attach the EA to your MT4 chart as usual. In the settings window, click “Load” to import the pre-configured .set file included in the EA archive. Select the desired file and confirm to complete the installation. For novice traders who are new to Forex EAs, it is recommended to first study basic courses like “Automated Forex Trading” to better understand and use the Shater EA.

Unique Strategy: Precise Trading

The trading strategy of the Shater EA is one of its highlights. It combines the grid-averaging strategy with standard MetaTrader 4 indicators (mainly multiple ATR indicators). When it comes to choosing entry points, it determines the optimal entry opportunities through ATR-based signals. For grid construction, when the market experiences a drawdown, it opens subsequent orders at predefined intervals (the default is 150 pips for 5-digit quotes). In the profit closing process, once the overall profit target is achieved, it closes the entire grid of orders, fully taking advantage of market volatility to gain profits. In addition, the system’s parameters are highly customizable, including grid spacing, lot size (fixed or dynamic), ATR optimization, etc. Traders can adjust them flexibly according to their own trading styles and market conditions.

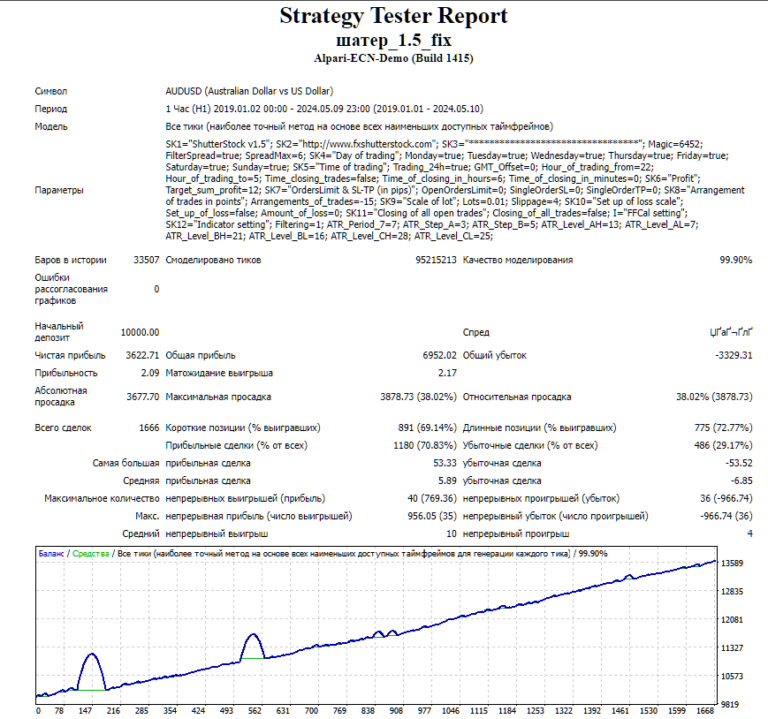

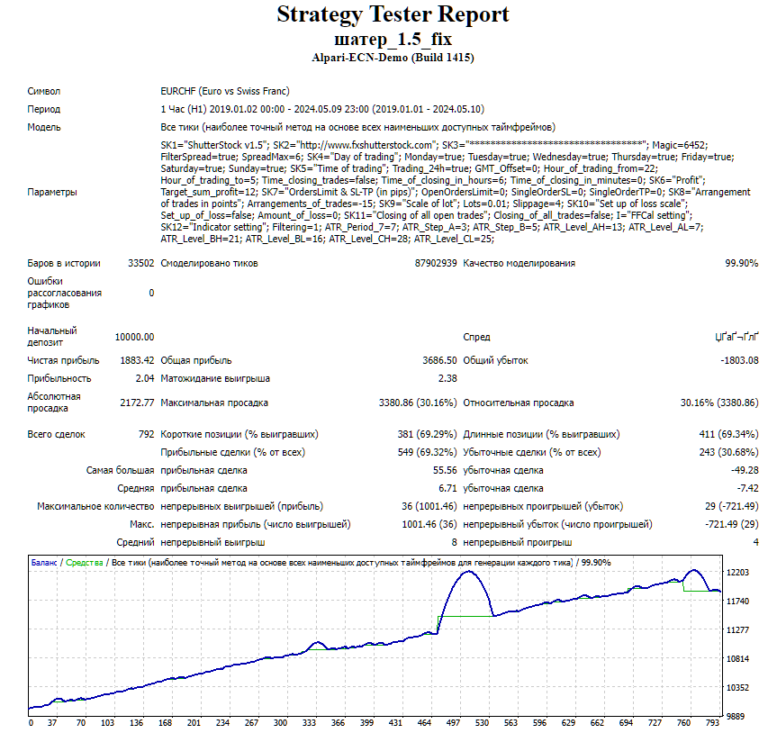

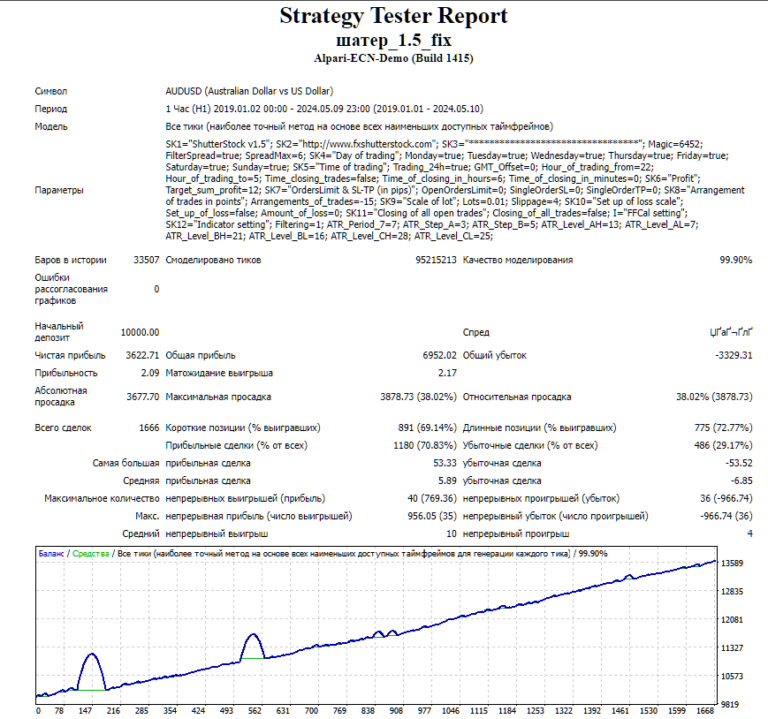

Test Results: Proving with Data

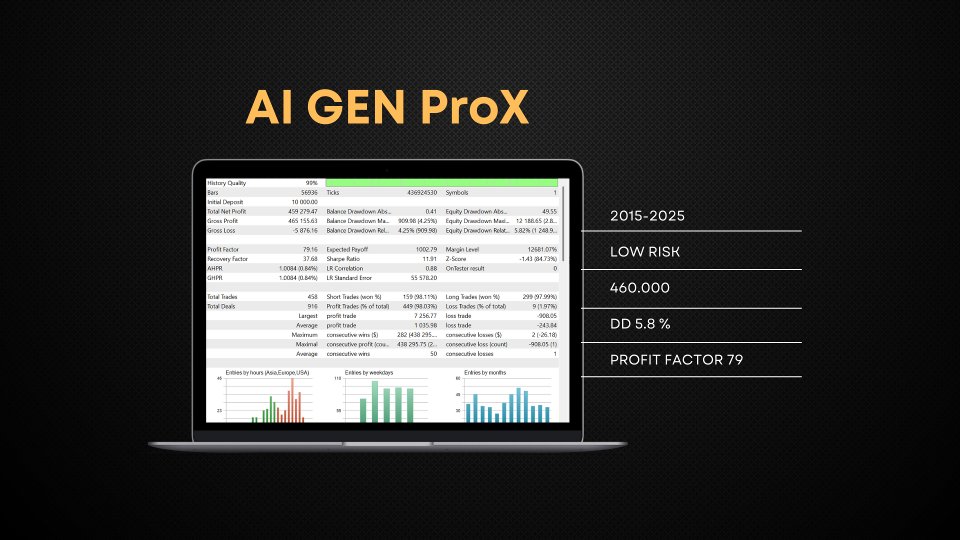

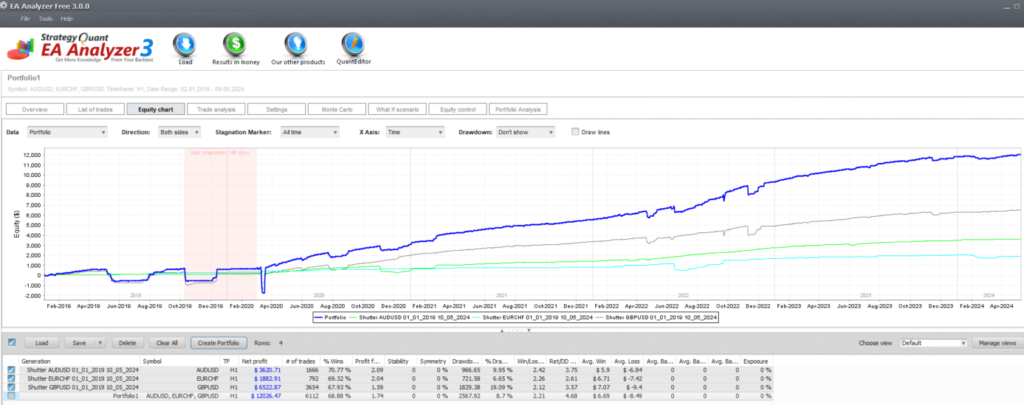

In the backtesting phase, due to the limitations of the MT4 platform, tests were conducted separately for each currency pair. From January 1, 2019, to October 5, 2024, both EURCHF and GBPUSD achieved acceptable profits. The portfolio analysis conducted through EA Analyzer shows that the combined portfolio has shown a continuous growth trend since April 2020. The complete backtest files can be obtained from the forum thread linked below.

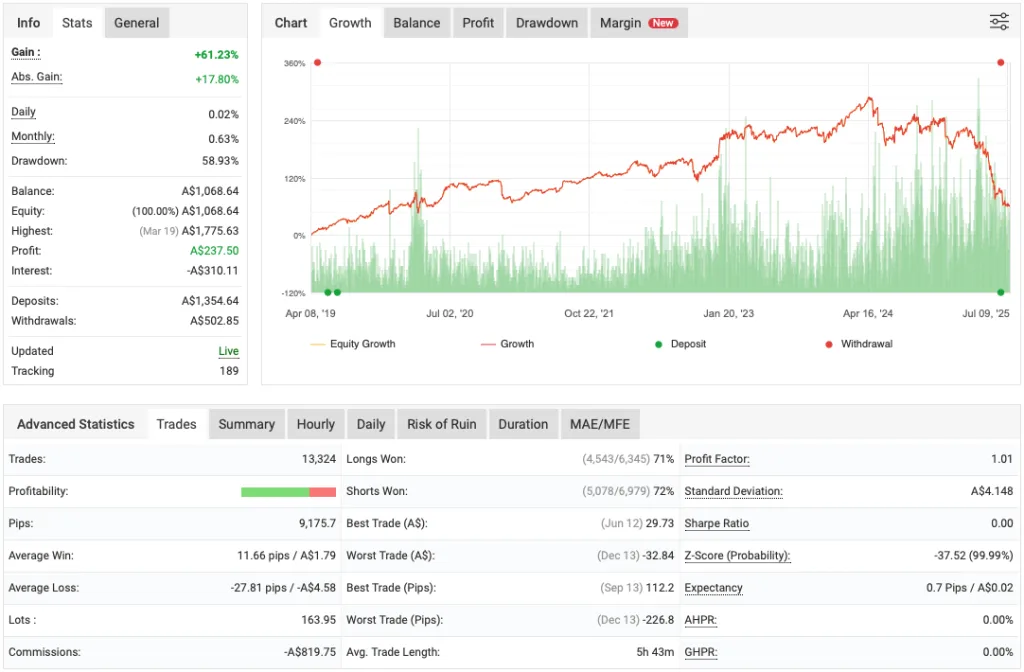

In terms of live monitoring performance, observations of active monitoring accounts through the Myfxbook platform show that the system can achieve stable returns, although there are occasional pauses for technical adjustments. Currently, the monitored currency pairs are AUDUSD and GBPUSD. From the perspective of annual performance, during the period from 2022 – 2024, the system was most efficient in summer and at the end of the year. Breaking it down by currency pair, GBPUSD has the highest returns, AUDUSD is the most stable, while EURCHF has relatively weak profitability.

Shutter Portfolio from EA Analizer

Parameter Settings: Flexible Control

In version 3.0 of the Shater EA, there are a wealth of parameters available for advanced customization. In terms of trade execution, parameters include the magic number, spread filter, trading hours, and forced closure timers. Grid configuration parameters involve order spacing and the maximum number of open orders. Risk management parameters include stop-loss per order and the maximum drawdown threshold. Lot size can be set as fixed or dynamic, and profit targets can also be configured. ATR optimization covers filtering levels and period adjustments. However, before actually deploying to live trading, it is essential to fully test the configurations in the MT4 Strategy Tester to ensure the feasibility of the trading strategy.

Practical Suggestions: Providing Guidance

Based on a comprehensive analysis of the Shater EA, we offer the following key suggestions. In terms of risk management, it is necessary to use conservative lot sizes and leverage ratios to avoid serious losses caused by excessive market volatility. When selecting currency pairs, give priority to GBPUSD and AUDUSD, as these two currency pairs performed better in the tests. In daily trading, regularly check the drawdown situation and adjust the settings in a timely manner during periods of high market volatility. At the same time, study grid and martingale strategies in depth to fully understand the risks involved. Only in this way can you better master the Shater EA and move forward steadily in the Forex market.

If you also want to try a systematic approach to trading in the Forex market, you might as well download the Shater EA and learn more about it. Maybe it is the trading tool you have been looking for. But before using it, please be sure to read the following important risk warnings carefully:

Important Risk Warnings

The Forex market is inherently uncertain. Exchange rate fluctuations are affected by multiple factors, such as global economic data, political events, and geopolitical conflicts. Prices may fluctuate significantly in a short period. Although the grid trading strategy adopted by the Shater EA has its unique features, it also has inherent risks. In a one-sided market, continuous grid averaging may lead to a rapid increase in the holding cost. If the market trend remains unfavorable, losses will expand exponentially, and it may even deplete the entire account balance. In addition, even if historical backtesting and live monitoring show profitable performance, past performance cannot fully guarantee future returns. The market environment can change at any time, leading to the failure of the strategy. Therefore, before using the Shater EA for trading, traders must fully understand these risks, ensure that their risk tolerance matches their trading behavior, and do not trade blindly.